| Channel | Publish Date | Thumbnail & View Count | Download Video |

|---|---|---|---|

| | Publish Date not found |  0 Views |

Watch the latest Big Think video: https://bigth.ink/NewVideo

Join Big Think Edge for exclusive videos: https://bigth.ink/Edge

————————————————– ——————————–

Bill Ackman is one of the greatest investors in the world, and he has stated that he aims to have "one of the greatest investing track records of all time." As CEO of Pershing Square Capital Management, the hedge fund he founded, he oversees $19 billion in assets.

But before he became part of the elite, he learned the basics of investing in his early 20s.

This Big Think video is aimed at young professionals who are just starting out, as well as those who are more experienced but lack financial knowledge.

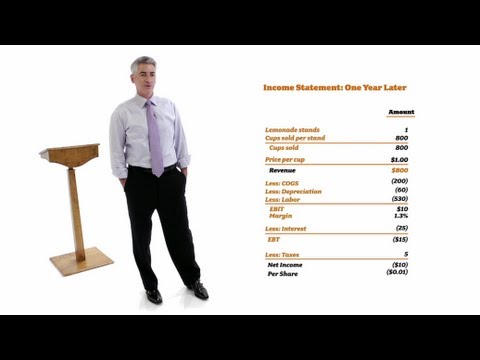

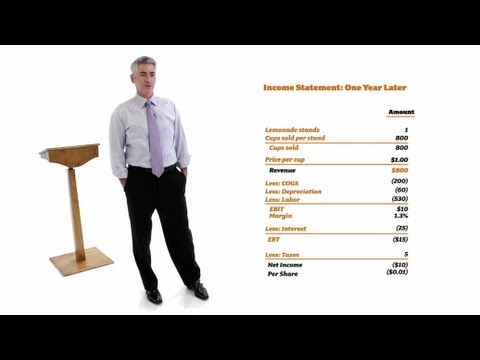

Ackman takes viewers through the creation of a lemonade stand to teach the basics, explaining how investors pay for equity, a word interchangeable with / "shares." In the example, the owner starts with 750, of which 250 comes from a loan. .

————————————————– ——————————–

WILLIAM ACKMAN:

William Ackman is founder and CEO of Pershing Square Capital Management. Established in 2003, the hedge fund has acquired significant stakes in companies including JC Penney, General Growth Properties, Fortune Bands and Kraft Foods. Ackman advocates "activist investing" strategies, the practice of using shares of publicly traded companies to influence management practices in a way that benefits shareholder interests.

————————————————– ——————————–

TRANSCRIPTION:

Hello, my name is Bill Ackman. I'm the CEO of Pershing Square Capital Management and I'm here today to talk to you about everything you need to know about finance and investing. I'll have it done in an hour and you'll be good to go. .

How to start and grow a business

So let's get started. We will do business together. We're going to start a business and we're going to open a lemonade stand and now I have no money left today, so I'm going to have to raise money from investors to start the business. So how am I going to do this? Well, I'm going to start a company. It's a small file that we file with the State and we find a name for a company. We'll call it Bill's Lemonade Stand and we'll raise money from outside investors. We need some money to get started, so we will start our business with 1,000 shares. We just made up this number and we're going to sell 500 more shares for 1 coin to an investor. The investor will put 500. We will put the name and the idea. We're going to have 1,000 shares. He will have 500 shares. He's going to own a third of the company for his 500.

So what is our business worth to begin with? Well, it's worth 1500. We have 500 in the bank plus 1000 because I had the idea to start the company. Now I'm going to need a little over 500, so what am I going to do? I'm going to borrow some money. I'm going to borrow from a friend and he's going to lend me 250 and we're going to pay him 10% interest per year for that loan.

Now why are we borrowing money instead of just selling more shares? Well, by borrowing money, we keep a larger share of the shares for ourselves, so if the company succeeds, we'll end up with a higher percentage of the profits.

So now we're going to take a look at what the business looks like on a piece of paper. We're going to look at what's called a balance sheet and a balance sheet tells you where the business is, what your assets are, what your liabilities are and what your net worth or equity is. If you take your assets, in this case, we collected 500. We also have what we call goodwill because we said the company: in exchange for the 500, the person who put the money only got a third of the company. The remaining two thirds belong to us for starting the business. That’s $1,000 worth of goodwill for the company. We borrowed 250. We're going to owe 250. It's a liability. So we have 500 in cash from selling stock, 250 from taking on debt and we owe a loan of 250 and we have a company that has, and you'll see on the graph, equity of 1,500, c This is therefore our starting point.

Now let's keep moving forward. What should we do to start our business? We need a lemonade stand. This will cost us around 300 euros. This is called immobilization. Unlike lemon, sugar or water, it's a bit like a building that you buy and build. It wears out over time, but it is a fixed asset. And then you need inventory. What do you need to make lemonade? You need sugar. You need water. You need lemons…

Read the full transcript at https://bigthink.com/videos/learn-to-invest-and-start-a-business-in-under-an-hour

Please take the opportunity to connect and share this video with your friends and family if you find it useful.